Calculate paycheck with 401k contribution

ASCII characters only characters found on a standard US keyboard. Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match.

401k Contribution Calculator Step By Step Guide With Examples

One thing that doesnt change no matter where you live in the country is FICA tax withholding.

. Note that if you have any after-tax paycheck withholding health or dental insurance premiums etc you will need to add them to the Total Withholding before calculating your net pay. Money that you contribute to a. Any contribution will be in Box 12 of the W-2.

Medicare tax rate is 145 total including employer contribution. Years invested 65 minus your age Your initial balance. 401k health insurance HSA etc.

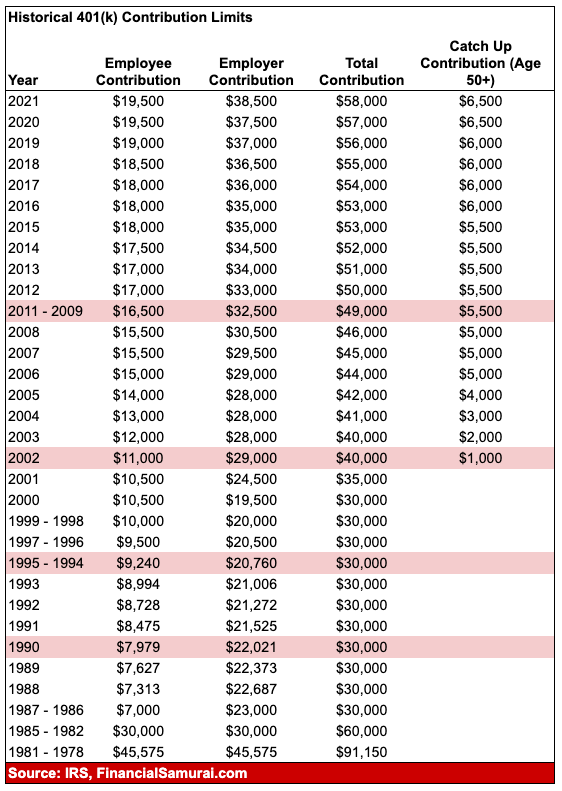

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Simply enter the amount you want withheld from each paycheck. No after-tax income contribution although more power to you if you have the disposable income to do so.

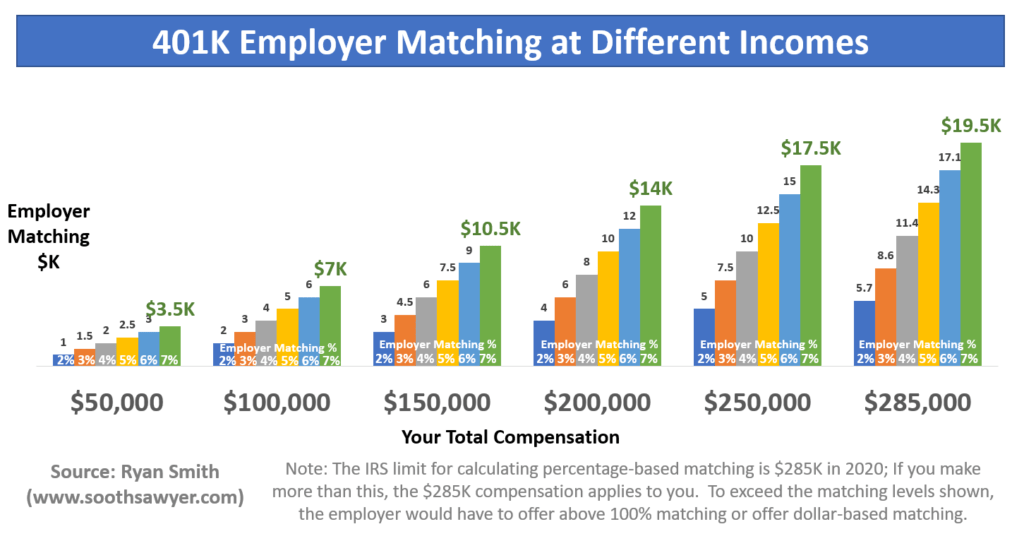

Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future. Check with your plan administrator for details. Try to meet or exceed their matching amount to make the most of your retirement savings.

Diversity Equity Inclusion Toolkit. Our free 401k Calculator for Excel can help you estimate how much you could have after investing for a certain number of years. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes.

Inflation has exploded in the first half of 2022 all the way up to 91 in July so the 2023 contribution limits for many of these accounts will be increased. 401k Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make. How Your Massachusetts Paycheck Works.

A highly compensated employee can only use the first 305000 of their annual income to calculate their maximum 401k contribution limit. If you can afford it consider putting more into an employer-sponsored retirement account like a 401k or 403b. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k.

Wonder what your 401k balance could be by the time you retire. In fact if you know the latest inflation numbers it is possible to calculate the increase even before the IRS announces it in October or November. The IRS adjusts the maximum contribution amount to account for cost-of-living and announces the annual limits for each type of 401k at least a year in advance.

Plus many employers provide matching contributions. See what happens when you increase your contributions. We assume you will live to 95.

One way you can affect your take-home. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. You only pay taxes on contributions and earnings when the money is withdrawn.

Company match assumption is between 0 100 of employee contribution. For most people the maximum contribution to a 401k plan is 20500 in 2022. The money that you put into these accounts is taken out of your paycheck before taxes are applied helping you to lower your taxable income which leads to tax savings.

Paycheck Protection Program Guide. A person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. ADP 401k Essential is a smarter 401k for small businesses designed to be simple customizable.

Income tax returns must be. It takes into account your existing balance annual raises in your salary your employers contributions and the estimated rate of return. Your 401k plan account might be your best tool for creating a secure retirement.

If you are more than 50 years old you can make an additional catch-up contribution of 6500 for a total of 27000. One option that Nevadans have to shelter more of their paycheck from Uncle Sam is to put more money into pre-tax retirement accounts such as a 401k or 403b. What Happens If I Exceed My 401k Limit.

Traditionally the IRS has provided an additional contribution option for savers age 50 and older to enable them to prepare for their pending retirement - 6500 in 2021. We assume that the contribution limits for your retirement accounts increase with inflation. But it will also depend on your marital status your pay frequency and any deductions from your earnings.

The size of your paycheck will depend of course on your salary or wages. 61000 is the total 401k contribution for. How Income Taxes Are Calculated.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. A financial advisor in South Carolina can help you understand how taxes fit into your overall financial goals. The closer you get to October the more accurate your projection can.

You may change any of these values. Contribute to your 401k. To calculate net pay subtract the total withholding for the pay period from the gross wages for the period.

We stop the analysis there regardless of your spouses age. 290 for incomes below the threshold amounts shown in the table. The maximum 401k contribution by an employee in 2022 is 20500.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Increasing your contribution will help you reach your retirement savings goals and it will also help you lower how much you pay in taxes.

If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. Some employers even offer contribution matching. ERISA or the Employee Retirement Income Security Act of 1974 sets minimum standards for retirement plans and protects retirement savings from.

Must contain at least 4 different symbols. Note that we will use 8 as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage. Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income.

ADP will collect this fee on behalf of SPS and will calculate this fee for each billing period by multiplying 1 the average daily balance of your Plans. We automatically distribute your savings optimally among different retirement accounts. How You Can Affect Your South Carolina Paycheck.

The rate of return assumptions are between 0 10. 6 to 30 characters long.

After Tax Contributions 2021 Blakely Walters

Download 401k Calculator Excel Template Exceldatapro

Excel 401 K Value Estimation Youtube

Download 401k Calculator Excel Template Exceldatapro

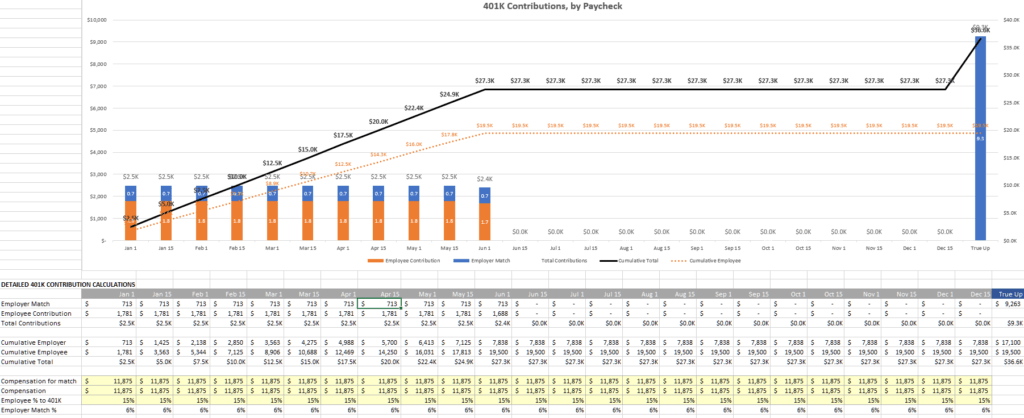

401k Employee Contribution Calculator Soothsawyer

401k Contribution Impact On Take Home Pay Tpc 401 K

401k Employee Contribution Calculator Soothsawyer

Strategies For Contributing The Maximum To Your 401k Each Year

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Paycheck Calculator Take Home Pay Calculator

What Is A 401 K Match Onplane Financial Advisors

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401 K Maximum Employee Contribution Limit 2022 20 500

Doing The Math On Your 401 K Match Sep 29 2000